Three Surprising Risk Management Ideas for 2026

Year-ahead commentary is challenging for us: We don’t have a crystal ball, and we believe predictions contribute more to investment mistakes than outperformance. But the

Investments that systematically manage downside risk have two main benefits:

Greater flexibility to match a portfolio to an investor’s risk tolerance.

An objective to mitigate drawdowns, which stress out clients and prompt them to make bad long-term decisions.

The traditional way to manage downside risk is through diversification across asset classes such as stocks and bonds. This method, called strategic asset allocation, is one of the most effective risk management tools in investing. Systematic risk management strategies like tactical trend-following or multi-factor equity can supplement traditional risk management by targeting additional ways to buffer against downside risk.

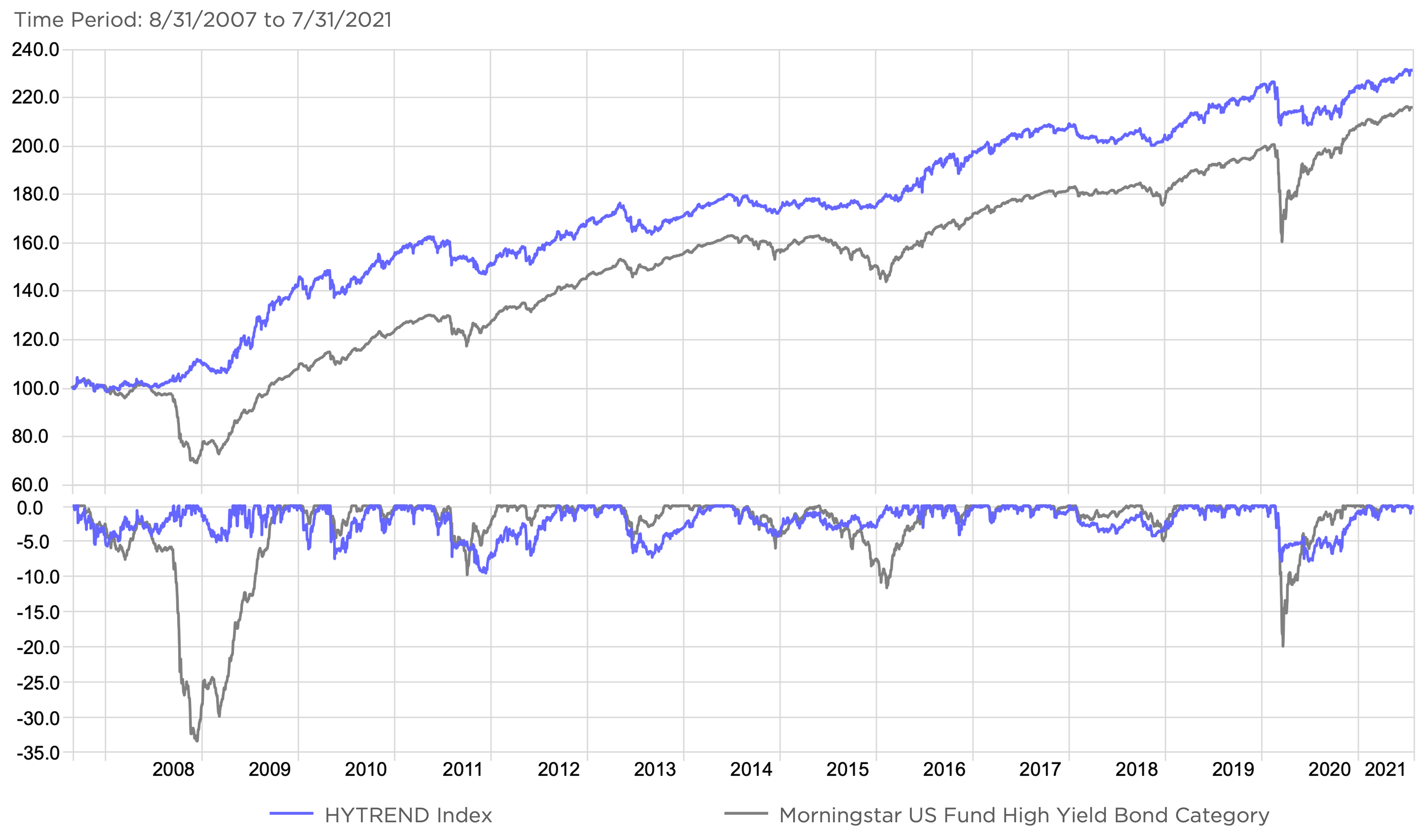

Source: Morningstar. The indices shown are for informational purposes only and are not reflective of any investment. As it is not possible to invest in the indices, the data shown does not reflect or compare features of an actual investment, such as its objectives, costs and expenses, liquidity, safety, guarantees or insurance, fluctuation of principal or return, or tax features. Past performance is no guarantee of future results.

There is no guarantee that any investment strategy will achieve its objectives, generate profits or avoid losses.

Inflation puts investment grade bond portfolios at risk, especially when interest rates are already low. Tactical trend following in high yield credit has potential to capitalize on high yield’s historical resilience in rising rate environments, while managing the downside associated with added credit risk.

Year-ahead commentary is challenging for us: We don’t have a crystal ball, and we believe predictions contribute more to investment mistakes than outperformance. But the

The Counterpoint Tactical Equity Fund (CPIEX) combines two investment approaches in a single fund: The fund layers these strategies on top of one another: Returns

San Diego, California – February 11, 2025 – Counterpoint Funds, a quantitative mutual fund and ETF provider specializing in diversifier strategies, today announced that the

Watch Chief Investment Officer & Partner, Michael Krause and Daniel Krause, Partner & Head of Sales at Counterpoint Mutual Funds, provide an update on Counterpoint’s fixed income funds, as well as share our fall investment outlook on fixed income performance.

Analysts’ price targets and recommendations contradict stock return anomaly variables. Using an index based on 125 anomalies, we find that analysts’ annual stock return forecasts are 11% higher for anomaly-shorts than for anomaly-longs. Anomaly-shorts’ return forecasts are excessively optimistic, exceeding realized returns by 34%. Recommendations also tend to be more

Using a sample of 97 stock return anomalies, we find that anomaly returns are 50% higher on corporate news days and are 6 times higher on earnings announcement days. These results could be explained by dynamic risk, mispricing via biased expectations, and data mining. We develop and conduct unique tests

Unmanaged index returns do not reflect any fees, expenses or sales charges. Past performance is no guarantee of future results.

© 2024 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

5516-NLD-09/01/2021

We’ve received your request for the featured event collateral. A Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your meeting request and a Counterpoint Funds team member will be in touch shortly.

Subscribe to stay up to date on and receive our monthly perspective.

We’ve received your event registration request and will be in touch shortly.

Subscribe to stay up to date on Counterpoint Funds and receive our monthly perspective.

We have received your application and look forward to reviewing your qualifications for the role. If your application seems like a good fit, we will contact you to discuss next steps.

Thank you again for your application and interest in joining the Counterpoint team!

We’ve received your message. A Counterpoint Funds team member will contact you soon.

Subscribe to stay up to date and receive our monthly perspective.