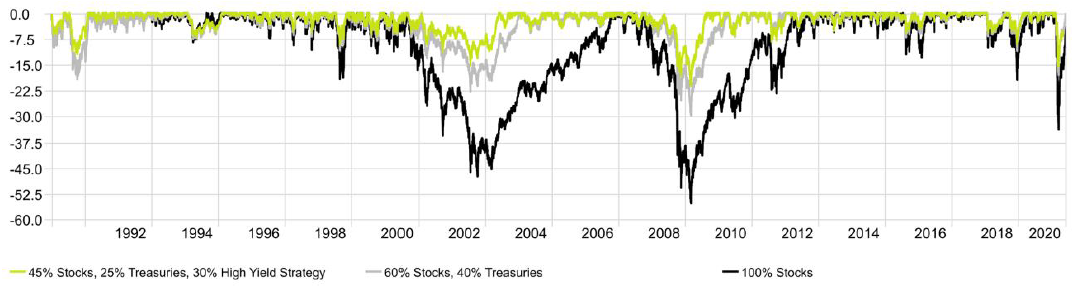

Investors need to understand how their strategies can handle market downturns, especially when market prices are rising despite bearish economic evidence. Tactical high yield investment strategies have historically excelled at reducing drawdowns – the declines from an investment’s most recent highs to its most recent lows. This risk management approach is valuable because it can reduce client – advisor friction and may allow investors to capitalize on opportunities in times of market stress.

Portfolio drawdowns can strain investor – client relationships. They’re a source of hasty emotional decisions that can derail any strategy. Troubled by declines in portfolio value, investors are tempted to abandon their strategies and sell at exactly the wrong time. Tactical trend following in high yield seeks to mitigate drawdowns by using a systematic, quantitative risk signal. Historically, this system has helped investors avoid severe portfolio drawdowns.

Drawdown of a Traditional 60-40 vs. 45-25-30 with High Yield Strategy

Many advisors encourage clients to remain invested, or invest more, during market downturns so they can attempt to capitalize when assets become cheap on a fundamental basis. Tactical strategies provide flexibility and seek to be more opportunistic when time comes to rebalance. By following “risk off” signals and investing in lower-volatility assets like cash and short-term Treasuries, tactical income strategies may help reduce drawdowns amid broad market declines. This active risk management mission helps investors avoid emotional decisions and take advantage when buying opportunities arise.

Tactical high yield strategies have the ability to offer strong risk-adjusted returns, and historically have been effective in managing risk when markets appear disconnected from economic reality. By targeting avoidance of emotionally draining drawdowns and enabling advisors to act opportunistically, tactical high yield strategies may help optimize investment portfolios for potential market downturns.