Amid concerns about slowing economic growth and the U.S. national debt, investors are again wondering what might happen to their portfolios in a declining interest rate environment. It’s a worthwhile question, but before advisors or their clients try to time rising or falling interest rates, it’s important to remember: As market narratives shift, a robust, systematic strategy can be incredibly valuable. To show what we mean, let’s look at a recent example of a market timing narrative that led many investors astray. In this case as in many, “doing nothing” would have been better than trying to respond to short-term sentiment.

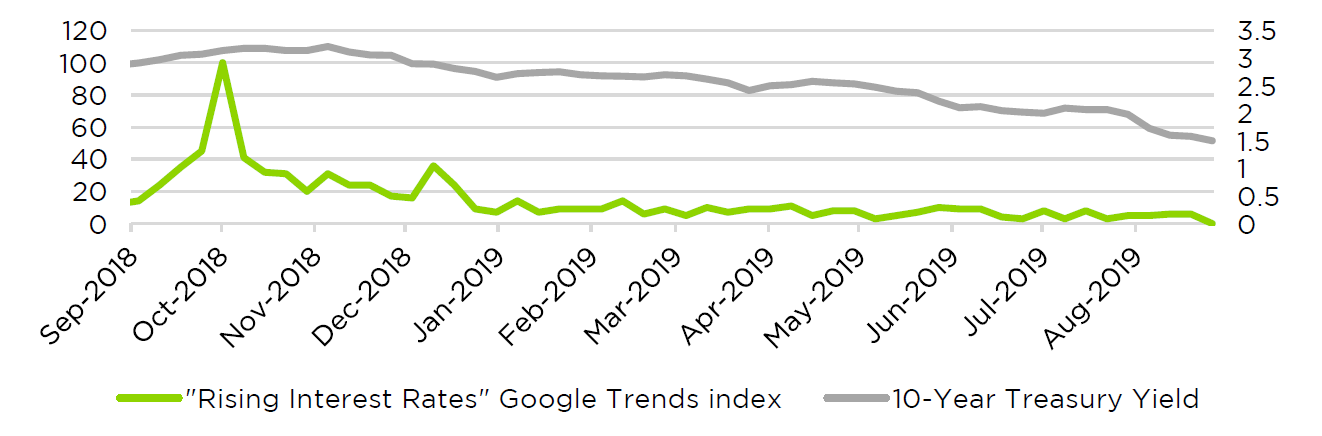

In October 2018, investors were preoccupied with what would happen if interest rates continued to rise, as Fed chairman Jerome Powell signaled the central bank was far from done tightening. The question went mainstream: USA Today asked readers, “Is it time to rate-proof your investment portfolio?” The Associated Press explained why rising interest rates were “shaking financial markets.” A reporter for Yahoo Finance discussed “what higher interest rates may mean for companies in 2019.” The news coverage likely both reflected and reinforced a spike in Google search interest in rising rates; searches for the term reached a 5-year high. The bond market is not fertile ground for internet memes, but in a sense rising rates went viral late last year.

You won’t believe what happened next: The benchmark 10-year Treasury yield peaked a few weeks later, then fell 170 basis points to today’s near-historic lows. So much for a rising interest rate environment.

Interest in Rising Interest Rates and 10-Year Treasury Yields

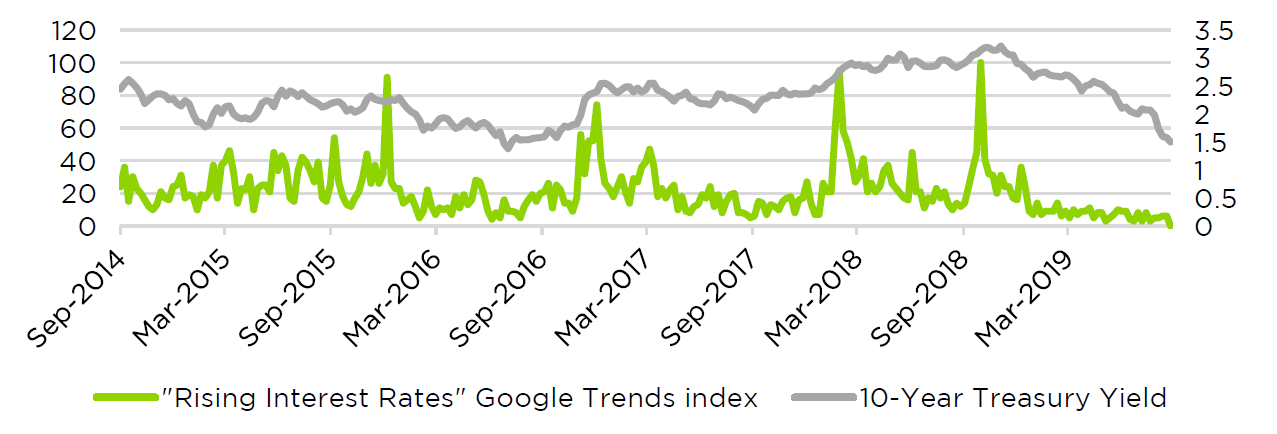

Looking back over the past five years, it’s hard to see the wisdom of the crowd when it comes to predicting the direction of interest rates. In fact, eyeballing the chart, it is more tempting to believe the opposite is true – that internet searches could provide a contrarian interest rate indicator. And contrarianism tempts many investors – if only we could zig while everyone else zags! In 2020, now that investors are concerned about falling rates, should we start zigging?

Interest in Rising Interest Rates and 10-Year Treasury Yields

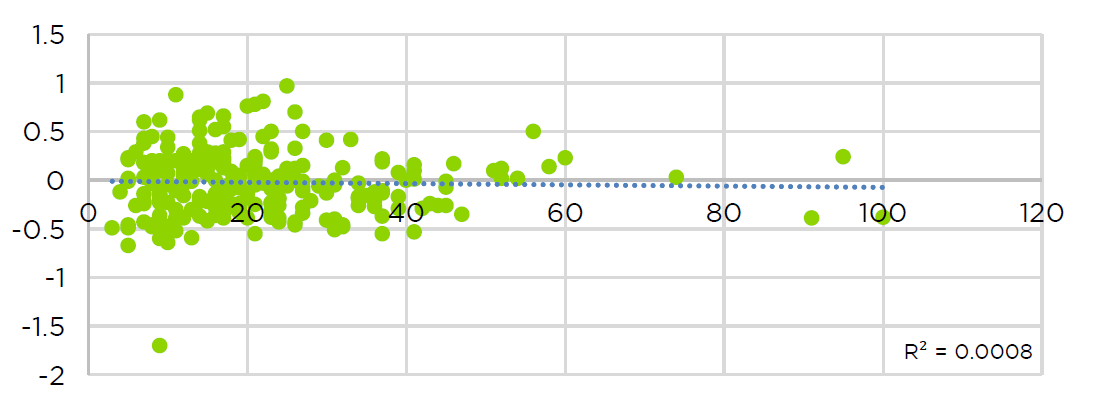

We’re pretty sure investors shouldn’t give in to contrarian temptation. When we plot search interest in rising rates against the direction of interest rates in the following 3 months, the data looks noisy and shows no statistical relationship (see that low R2). Neither a zig nor a zag appear to justify the cost of doing business – both amount to flailing in the dark.

Google Search Interest in Rising Rates and Forward 3-Month Change in 10-Year Treasury Yields

We started this discussion to see whether the prevailing sentiment can help us make decisions with regard to interest rates. At first examination of the events of late 2018, prevailing sentiment seemed to be a contrarian indicator. But on a further evaluation, we couldn’t determine anything meaningful. The “crowd,” defined as the financial news media and what everyone is looking at, is neither systematically right nor wrong, so there’s no advantage in trying to interpret its movements.

This illustrates the importance of a long-term strategy investors can stick to regardless of prevailing sentiment or the latest news. Apparent trends are occasionally contrarian indicators, but more often they’re just noise – or, by the time the trend is noticeable in market prices, it’s too late for investors to respond. We believe the best response to this phenomenon is to invest according to systematic processes with strong statistical support. These systems don’t worry about – or get distracted by – narratives that can lead investors astray.

Buy-and-hold index investing is one example of a systematic strategy, but it is not the only one. Counterpoint Tactical Income, for example, applies a systematic trend-following model which seeks to manage downside risk. The model does not require discretionary decisions based on news, allowing investors to rely on a process that over the long term should produce reasonable returns compared to risk.