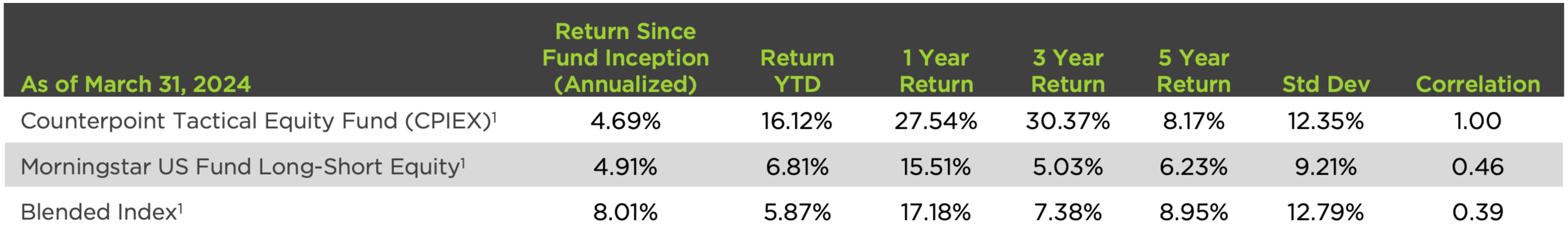

San Diego, California – April 29, 2024 – Counterpoint Funds, a quantitative mutual fund and ETF provider specializing in defensive diversifier strategies, today announced that the Counterpoint Tactical Equity Fund (CPIEX) is now ranked 1st and 41st for the 3 and 5-year periods out of 154 and 137 funds respectively in the Long-Short Fund category, based on total returns.

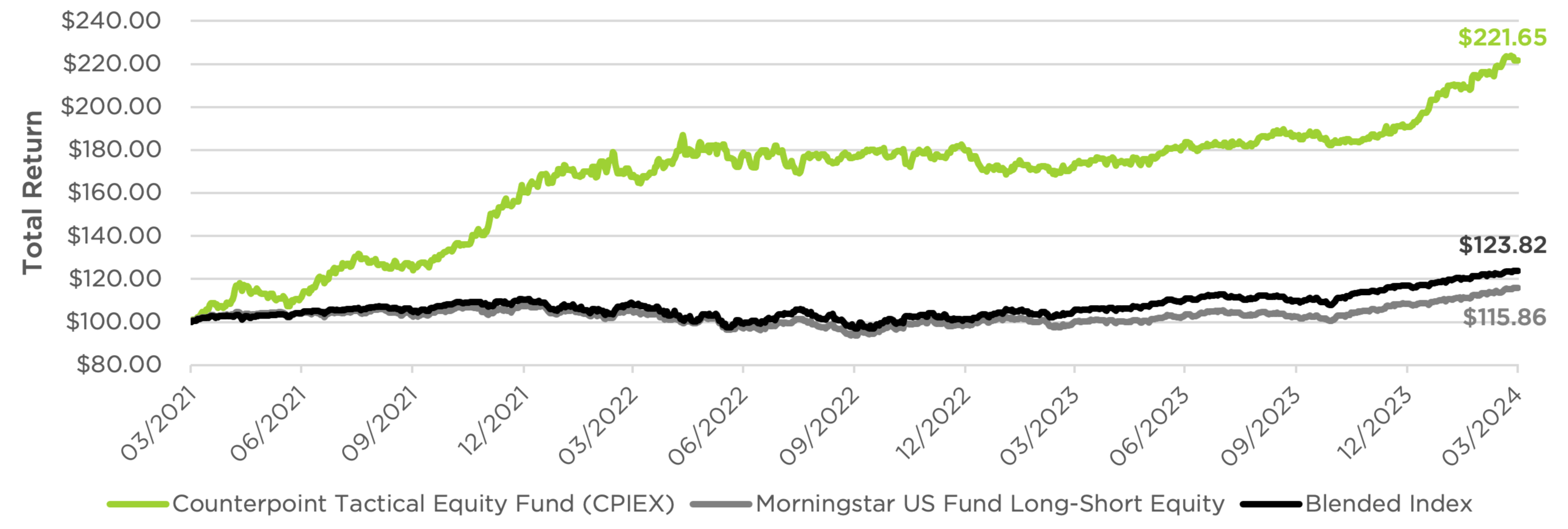

CPIEX, a 4-Star rated fund in the Long-Short Fund category based on risk-adjusted returns out of 154 funds for the 3-year and 137 funds for the 5-year period ending March 31, 2024, by Morningstar Inc., a leading provider of independent investment research, delivered a 3-year annualized return of 30.37% versus 5.03% and 7.38% for the Morningstar Long-Short Fund Category and the Fund’s Blended Index1.

Growth of $100 – 04/01/2021 to 03/31/2024

“We are very pleased with the performance of the Counterpoint Tactical Equity Fund as a strong equity diversifier over the last 3-years as well as year-to-date,” says Michael Krause, CFA, co-founder and co-portfolio manager of Counterpoint Funds.

Developed by Counterpoint Funds, the Counterpoint Tactical Equity Fund (CPIEX) launched Nov., 2015, and had $92.9 million in net portfolio assets as of March 31, 2024. CPIEX seeks capital appreciation and capital preservation by investing in a global long-short portfolio, designed to be currency and sector neutral, while using a tactical model to adjust stock market exposure. Employing a long history of empirical evidence and academic research, the Fund leverages advanced machine learning and artificial intelligence techniques to dynamically adjust exposure to factors including momentum, value, sentiment, quality, and long-term reversal, during the stock selection process to seek optimal mispricing opportunities. This is used in combination with a tactical overlay of the US Stock Market, which was designed to provide exposure during periods of market appreciation and reduce market exposure during extended market downswings, to provide a low correlation strategy that makes a great equity diversifier for client portfolios.

“The dynamic mispricing strategies utilized by CPIEX are designed to perform well in alignment with long-term data on investor behavior. This is especially true in bear, flat or high-quality bull markets, as this is when the mispricing, or behavioral mistakes investors have made, are historically corrected,” added Mr. Krause. For more information on the Tactical Equity Fund please visit cpfunds.com/cpiex

About Counterpoint Funds

Counterpoint Funds is a defensive, systematic and research driven mutual fund and ETF provider with 5 funds and over $1.8 billion in assets under management. Counterpoint is focused on offering defensive fixed income and equity diversifier strategies designed to drive portfolio performance over the long run. Counterpoint’s mutual funds and ETF employ quantitative investment strategies that base asset allocation and security selection decisions on academic research and statistical analysis. Counterpoint Funds, LLC, is located at: 12760 High Bluff Drive, Suite 280, San Diego, CA 92130. Tel: 844-273-8637

NOT FDIC INSURED – MAY LOSE VALUE – NO BANK GUARANTEE

Press Contact

Counterpoint Funds

John Held

VP of Marketing

+ 1 (858) 859-8815

press@counterpointmutualfunds.com

Watch the most recent on-demand equity webinar:

The Counterpoint Winter 2025 Equity Update

DATE: Tuesday, February 11, 2025

LOCATION: On-Demand Webinar